Interactive Learning: How Money Games Can Change Your Approach to Finance

In today’s fast-paced digital age, teaching financial literacy to our children can be quite a challenge. Traditional methods like textbooks and lectures often fail to engage young minds. As a family-oriented mom, I am always on the lookout for innovative ways to instil crucial life skills in my children. Recently, I discovered a new approach that not only captures their attention but also provides valuable lessons: interactive money games.

The Importance of Financial Literacy

Financial literacy is essential for everyone, regardless of age. Understanding how to manage money, budget, save, and invest are skills that can significantly impact one’s quality of life. As parents, it is our responsibility to ensure our children are equipped with these skills early on. However, conveying these concepts in an engaging manner is where the challenge lies.

The Role of Interactive Learning

Interactive learning is a powerful educational tool. It transforms passive learning into an active experience, making complex subjects more accessible and enjoyable. Interactive money games, in particular, are designed to simulate real-life financial scenarios, allowing players to learn by doing. This hands-on approach is not only more engaging for children but also more effective in retaining information.

Discovering Money Games

During my quest to find interactive learning tools, I stumbled upon a treasure trove of online money games on the Mortgage Calculator website. This site offers a variety of games that cater to different aspects of financial literacy, from budgeting and saving to investing and managing credit.

Integrating Money Games into Family Time

One of the best ways to incorporate these educational games into our routine is by integrating them into our family time. Setting aside a specific time each week to play these games together not only promotes learning but also strengthens family bonds. Here are a few games from the website that my family and I have particularly enjoyed over the last few weeks:

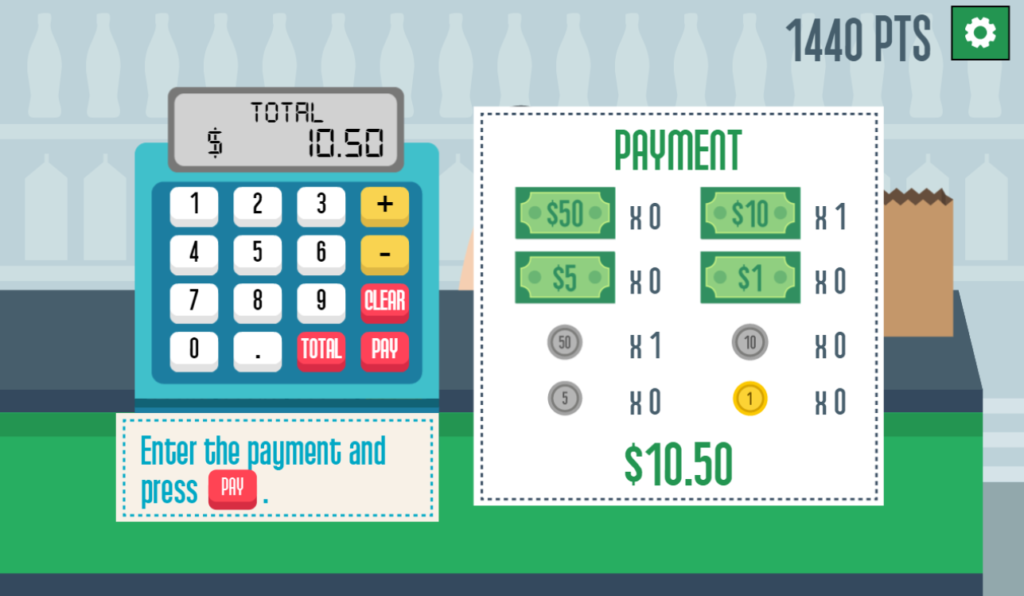

1. Grocery Cashier

The Grocery Cashier game is a fantastic way to teach kids about budgeting and basic arithmetic. Players take on the role of a cashier at a grocery store, where they must add up the prices of items, give the correct change, and manage the cash register. This game reinforces the importance of accuracy and speed, and it provides a practical application of math skills. My kids found it both challenging and fun, and it sparked interesting discussions about the value of money and the cost of everyday items.

2. Pizza Shop

In the Pizza Shop game, players run their own pizzeria, introducing concepts of supply and demand, cost management, and profit margins. My children loved the creativity involved in designing pizzas while learning about business operations. The vibrant graphics and intuitive gameplay kept them entertained while subtly teaching them about business management and the importance of customer satisfaction. I particularly appreciated how the game encouraged strategic thinking and time management skills.

3. Cash Back

Cash Back is a simple yet effective game that teaches kids about making correct change. Players must calculate the correct amount of change to give back to customers in a limited amount of time. This game is great for younger children who are just starting to learn about money, as it has a bright, user-friendly interface and straightforward gameplay which reinforces basic math skills and the concept of currency.

Learning Beyond the Screen

While these games are an excellent starting point, it’s important to extend financial lessons beyond the screen. Here are a few strategies we’ve incorporated into our daily lives to complement the lessons learned from these games:

1. Real-Life Practice

After playing the “Grocery Cashier” game, we started involving our children more in real-life shopping trips. They help create the shopping list, compare prices, and calculate the total cost. This hands-on experience reinforces the skills they’ve learned and gives them a sense of responsibility.

2. Family Budget Meetings

Inspired by the “Pizza Shop” game, we began holding monthly family budget meetings. We review our household expenses, set financial goals, and discuss ways to save money. Involving the kids in these discussions helps them understand the importance of budgeting and financial planning.

3. Saving and Investing

Games like “Cash Back” sparked conversations about saving and investing. We opened savings accounts for our children and set up a small investment fund. They contribute a portion of their allowance to these accounts and track their progress. This practice teaches them the value of saving for the future and the basics of investment growth.

The Impact on Our Approach to Finance

Integrating money games into our family routine has had a profound impact on our approach to finance. My children are more interested in financial topics and are developing a solid foundation in financial literacy. They understand the value of money, the importance of budgeting, and the benefits of saving and investing. More importantly, they are learning these skills in a fun and engaging way.

Final Thoughts

As parents, we strive to provide the best education for our children, equipping them with the skills they need to succeed in life. Financial literacy is a crucial component of this education. Interactive money games offer a unique and effective way to teach these essential skills. By integrating these games into our family routine and extending the lessons beyond the screen, we can foster a deeper understanding of finance and prepare our children for a financially responsible future.

Exploring the games on the Mortgage Calculator website has been a delightful and educational journey for our family. I encourage other parents to explore these resources and discover the benefits of interactive learning. Who knew that playing games could be such a powerful tool in shaping our children’s financial future?

Leave a Reply